European VAT Refund + US Customs

Thursday, July 10, 2014I've heard about the VAT (Value Added Tax) refund for European tourists on luxury goods, but never had a reason to fill my brain with specifics until a few months ago. Right before I left for my Europe trip, I made up my mind to buy a Chanel reissue bag overseas because it's cheaper. According to my calculations, the savings should be around $800-1000 (comparing US price + state sales tax vs. European price - VAT refund) for the bag I had in mind. The only uncertain and possibly non-straightfoward part of this process was the VAT refund.

I did most of my research over at tPF in the Chanel Shopping forum. The ladies are full of knowledge and so helpful. Anything you'd want to know about the VAT refund rate (varies by country, usually 10-14%) to current bag prices to boutique inventory can be found throughout their many threads. Other sites that I found to be helpful: Global Blue's refund calculator (lets you enter purchase amount to determine tax refund by country) and Chanel Prices (lists worldwide current prices.)

Looking at the current exchange rate and the VAT refund % for the countries on my itinerary, I would save the most money by buying in Italy, then France (slightly less), then finally England (much, much lower.) If we had visited Italy before France, I would've bought my bag in Rome because the refund rate is 1-2% higher than in Paris. As it was, I didn't want to pass up on the opportunity to buy in France only to find out that the bag isn't in stock in Italy.

Another thing to think about beforehand is whether you want your refund back in cash or on a credit card. Cash refunds are 1-2% less but you get the money back immediately at the airport, whereas credit card refunds are higher but take a few weeks to process. I was greedy so I chose the credit card route, but then later read horror stories from people who never received their refund. It took about 5 weeks, but my refund did eventually show up on my credit card statement. Lets out big sigh of relief. If I were to go through this process again, I would choose to get cash back just for the peace of mind.

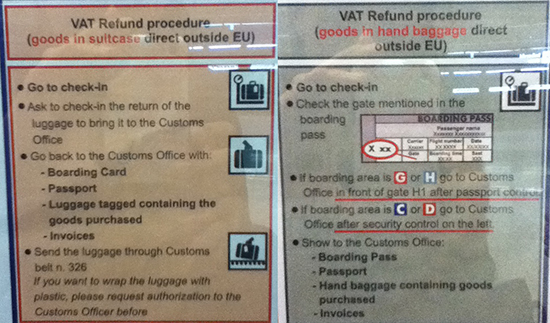

The VAT refund process consists of two steps. 1) When you make a purchase, the store will give you VAT refund forms that are filled out. This is also when you have to decide between cash or credit card refund so they can specify that on the paperwork (can't change your mind later.) 2) At the departure airport, have the refund forms stamped at the customs office. Then either drop it off at a designated mailbox (for credit card refunds) or stand in another line to get cash back.

Sounds easy enough, right? So our plan was to just arrive at the airport early in case of long lines at customs. But... right before we left for our trip, a friend (hi A!) asked if we have a direct flight back to the US from Rome? No, we have a layover in Germany... I think for an hour. Then she asked if I plan on putting my new bag inside checked luggage or carry-on? Carry-on. Bag is too expensive to not be with me at all times. Turns out, VAT refund forms must be stamped at the last port of departure out of the European Union. So if put my bag in my checked luggage, Rome would be the last port, but if I carry it with me, the last port is Germany. CRAP. An hour isn't enough time! So I turned to my BFF, Google, and read about people getting their VAT refund forms stamped at the first airport by showing their boarding passes with the short layover time. There were also others who were turned away by customs because it was not their last stop in the EU. Sigh. Nothing we can do now because our flights were already booked. So we decided to just go to the airport in Rome early and try out luck with customs. If that doesn't work and there isn't enough time in Germany, then apparently you can bring the VAT refund forms to the French embassy (or whichever country the purchase was made in) and have them stamped and mailed from there. Since I live in the DC area, the embassy idea could work as a last resort.

So many lessons learned! This is what happens when I don't put in any effort to making planning decisions, so I have no one to blame but myself. It's definitely a good idea to consider direct flights out of the EU and be picky about departure airports (if you can) because some are easier to navigate through than others. I was told (from a department store employee who works in their VAT office) that CDG airport in Paris has clear signs posted everywhere telling you where to go find customs and refund offices. They also have kiosks to scan the forms if you don't mind using a machine instead of waiting in line to speak to a person. I told him we were actually flying out of Rome and he grimaced, saying that airport isn't as easy to navigate. My advice would be to google your departure airport and familiarize yourself with their VAT refund process (where to go first, locations of customs/security/cash refund desk, hours, etc) as best as you can.

For refunds at FCO airport in Rome, I found this post and accompanying comments to be extremely helpful. Of course after reading other people's negative experiences with the refund process, I started feeling overly anxious. What if we can't find this supposedly hidden customs office and can't speak Italian to ask someone? What if we get stuck behind a huge group of Asian tourists at customs? Should we not bother sleeping tonight and just go to the airport extra early? DH just laughed at me before falling sleep. My worries were for naught (thank goodness.) There's no point in arriving before airline check-in counters open (usually 3-3.5 hours beforehand) because boarding passes are needed at customs. When we arrived at FCO, we didn't go very far before we saw a sign that was clearly labeled with VAT refund directions in multiple languages (!) near security:

Once we landed in the US, there was another series of steps before we could actually leave the airport. Immigration, pick up luggage, then customs. I declared my bag, so I figured there's a good chance I'll be questioned. I was a bit surprised at the amount of questions, but much more so at the actual questions that the immigration officer asked. I felt like the questions weren't going to trip anyone up, even if they had an elaborate story ready (granted, this was my first time not breezing through the airport, so I have no prior experience to pull from.) What is this number? What did you buy? Oh. That's a very expensive purse. Do you have it with you? What is your job? Did you buy it in Paris? What brand is it? Did you save a lot of money? That's a lot of money to spend on a purse. The grilling was more intense than what I'd imagine my parents putting me through, lol... and this was just the first hurdle! So I braced myself for round 2 of questioning at customs.

Yep, as I'd guessed correctly, I couldn't exit and was waved towards customs. This officer wasn't as nosy and just took out a calculator and said I had to pay 3% tax on the amount I declared. Afterwards, I learned from DH/SIL that everything is at the customs officer's discretion, ie: waiving items, charging between 3-9% tax on goods, etc. Supposedly leather products are to be taxed at a higher rate, so apparently we "lucked out" with our 3% tax.

I don't know how my experience compares to others who've arrived at IAD, or how it compares to IAD's reputation. I remember the consensus among my parents' friends was that customs at SFO is stricter than at JFK, so if they could, they'd try to book flights through NY, haha. This was about a decade ago, so who knows how much truth there is to that... anymore.

Was all the worrying and hassle worth saving money for? You bet. I ended up "saving" ~$950, which was in line with my initial estimate. Would I buy another expensive purchase from overseas in the future? Only if I win the lottery.

28 comments

LOL! omg that is a lot of work...but u did save a lot! can't wait to see the bag.

ReplyDeleteThe bag (good pic here) and my orange clutch are probably my two most used bags the last few weeks!

DeleteThank you for the thorough explanation, Cee! I had no idea how VAT works. We’re planning our Europe trip but I don’t think a Chanel purchase is on the list =) Although, it’s always great to learn something new. I will definitely keep this post in mind for future reference. I say it’s worth it. Your new addition is a beauty.

ReplyDeleteThe VAT refund works on other things too, not just luxury goods (though not on hotels or food I don't think), so definitely do some research before your trip to see if you can take advantage!

DeleteI'm excited for you and your Eurotrip next year!

Man that is complicated! Thanks for the rundown though. Question, that 3% you have to pay, do you do that on your taxes when you file next year or is it paid on the spot?

ReplyDeleteOf course! Always willing to help if I can :)

DeleteYou pay the customs tax right then and there. They wouldn't let you leave the office otherwise, haha.

Wow, my husband would kill me for making me go through all the trouble but saving $950 is a pretty amazing deal, so good for you! Hope you win the lottery!!

ReplyDeleteAlready on it... the next time something lucky happens to me, I'm going out and buying lottery tickets asap ;)

DeleteDid you pay with credit card? Credit card charge a percentage or a fix fee per transaction out side the US.

ReplyDeleteYep I paid with a credit card. I used one that doesn't charge a foreign transaction fee. It's from Capital One if you're interested. A few of my friends love Chase Sapphire, which also doesn't charge a foreign transaction fee, but does require an annual fee beyond the first year.

DeleteI thought I was being all smart and savvy by traveling with a no foreign transaction fee credit card, until I came back and was talking to my dad. He said that he's used two types of credit cards overseas before, one with a % fee and one without. When he received his billing statements, the conversion rates were different between the two cards... so it seems like companies that tout the "no foreign transaction fee!" on their cards do try to make up some $ by using higher conversion rates. I don't know... it may be worth more research.

Did capital one not give u a good rate? My no-fee chase cards always give me excellent market rates (nothing added on, pretty sure... I calculate everytime)

DeleteNo, the rate seemed reasonable to me. My dad just noticed that the rates on his no-fee cards weren't as good as the ones on the cards that charged fees. Don't know if it's just different companies with different rates? Some trying to make up for no-fees? We're not sure.

DeleteOk, your post just made my head spin! I can see why it was so stressful because so much money was involved.

ReplyDeleteI've been getting VAT back for years since I usually travel to Europe about once a year. However, I'm often leaving Europe from a small airport in Germany so it's usually just me and some custom officials. No long lines. Well, no lines at all. Just me! No major hassles at all. You can get VAT back on clothes, shoes, dishes, household items, etc. I have always taken it back in the form of cash (not credit).

I have to say that I commend you for your honesty in declaring your real purchase price to U.S. officials. Luckily the amount of merchandise you can bring into the U.S. without paying tax has gone up over the years. I remember when it used to only be about $200 worth of goods, now I think it's about $800 worth of goods you can bring in free of tax.

YES, I think the large amount of $ and the fact it was my first time going through the process just added to the stress. If it was one or the other, I would've handled it much better... or so I'd like to think ;)

DeleteYou would still need to make purchases over an X amount (something like 175 Euros?) to get VAT refund, right? And the limit has to be met at each store, if I remember correctly.

The limit is $800 now for singles or $1600 for a household, so hearing that it used to be $200 makes me o.O Oh how the times have changed!

I actually just returned from Europe. Went to Germany, Sweden, and Denmark. And it was the first time I didn't buy anything. What the heck?! I can't believe that happened. It has never happened. But a minimum of 175 euros sounds far too high. At least in the past, I know it was much lower.....more like 50 euros. But perhaps it has changed in recent years.

DeleteAnyhow, I enjoyed reading your post on the whole ordeal because you definitely reminded me of myself in that I analyze and plot everything out like you did. I would've been a basket case worrying about trying to get the VAT back in between my connecting flights. And I would've stressed out for weeks worrying I'd never get the refund on my credit card. I'm so glad it worked out for you.

Ha! There's a first time for everything and not spending money is never a bad thing ;)

DeleteMy curiosity got the best of me... looks like the minimum purchase amount is 154.94 EUR in Italy to claim a refund. I wouldn't be surprised if this amount is different for other countries though, and I can definitely see it being lower to attract tourists.

Thanks for the link to the Global Blue website. I've never checked it out until now. So of course I had to check the minimum for Germany since I'm almost always flying out of Germany. Minimum of 25 euros. MUCH better than Italy. Wow! I had no idea that it varied by country.

DeleteIt's funny how we had a gut feeling we were right (yours of Germany's minimum and mine of Italy's) but yet uncertain at the same time, haha. I'm happy to learn new things everyday! Time to add Germany to my list of countries to visit now ;)

DeleteLoved this post and am bookmarking it. We bought my engagement ring in England - and was able to get a sizable VAT refund on it since I was moving back to Canada before the wedding.

ReplyDeleteSounds like your VAT refund experience went much smoother than mine? Which I'd be glad to hear because I wouldn't want to wish this stress on others :)

DeleteThank you SO much. I searched everywhere to get an idea of how much tax to pay on luxury bags at customs. I plan on buying at some point in the future. 3% - 9% is reasonable.

ReplyDeleteThe questions and the rude, judgmental comments by the customs officer were strange. Yes, $4000 is a lot of money for a bag...so? Its your money, you spend how you wish. They should be glad you are honest and claiming your purchases. Many people don't.

You're most welcome! Hope you have a smoother experience when dealing with customs than I did ;)

DeleteNice explanation. This will be helpful for me.....:)

ReplyDeleteA Good blog always comes-up with new and exciting information, thank you for sharing useful content about VAT Refund Schemes.

ReplyDeleteNice post. Thanks for sharing this informative information with us. It's very helpful.

ReplyDeleteRegistration for VAT

Really it was an awesome article… very interesting to read…

ReplyDeleteThanks for sharing.........

tax return for self employed in London

Claim your GST refund with Lex N Tax Associates which allows businesses to recover excess GST paid on inputs or exports. The process involves submitting relevant documents and forms to the tax authorities, ensuring all conditions for eligibility are met. Timely and accurate filing is crucial to avoid delays in receiving the refund.

ReplyDeleteNavigating European VAT refunds and US customs can be complex, especially with the added layer of TBMD. For businesses, a seamless process is crucial. Engaging a professional for a comprehensive VAT consultancy can help ensure compliance and maximize your VAT refund, while a dedicated customs broker can expertly handle US import regulations. Simplifying these procedures is key to a smooth international transaction.

ReplyDeleteI'd love to hear from you. Constructive criticisms welcome!